FILE WITH FIRST FAMILY TRUST FROM THE COMFORT OF YOUR HOME OR IN OUR OFFICE

ABOUT FIRST FAMILY TRUST

First Family Trust is a full-service income tax preparation company specializing in the preparation of individual and self-employment tax returns. We pride ourselves on professional, accurate, and friendly services to our clients. Whether it is helping you receive the maximum refund you deserve or assisting you with your credit restoration needs, our tax professionals are committed to getting you the best result quickly and accurately. We are dedicated to making sure your experience with us is fast, easy, and enjoyable. By choosing First Family Trust, we can guarantee that you will receive the utmost quality in customer care, with the promise of exceptional service. Our tax professionals offer in-depth experience and industry-specific knowledge to deliver clients the insights and innovation they need to maintain compliance and drive value wherever they do business. Give us a call today to schedule an appointment.

TAX HELP YOU NEED AND THE BIGGEST POSSIBLE REFUND GUARANTEED!

First Family Trust provides unparalleled personalized tax services to a broad range of clients across the world. As your AFSP certified tax professionals, we are here to ensure that all your tax preparation needs are met accurately and as quickly as possible. We take pride in our ability to provide our clients with up-to-date knowledge on important IRS updates and changes. We are ready and able to serve as your tax professionals and help guide you down the path to success.

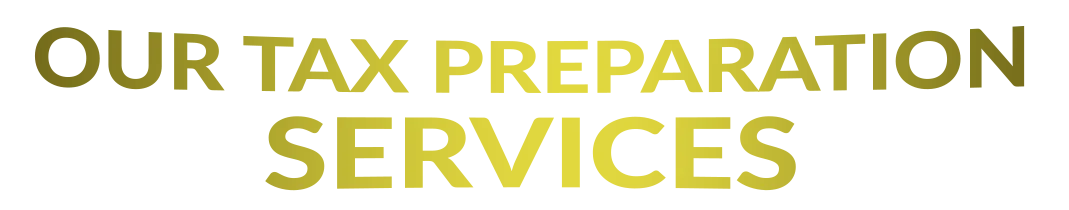

We offer a full range of tax preparation services to ensure a hassle-free tax season. We assist with tax planning to better manage your taxes.

WHY CHOOSE US?

Personalized Approach

We understand that every client's financial situation is unique. That's why we take the time to listen to your needs, concerns, and goals, tailoring our services to ensure the best possible outcomes for you.

Experience and Expertise

With years of experience in the tax industry, our team of certified professionals is well-versed in the ever-changing tax codes and regulations. We stay up-to-date with the latest developments to provide you with accurate and reliable advice.

Client Satisfaction

Our track record of satisfied clients speaks for itself. We're proud to have helped individuals and businesses not only meet their tax obligations but also achieve financial success.

Ready to simplify your tax season? Contact us today to schedule a consultation. We're here to answer your questions, provide guidance, and set you on the path to financial success.

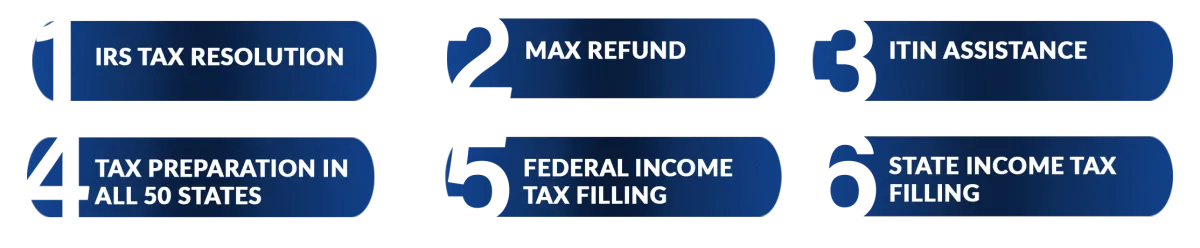

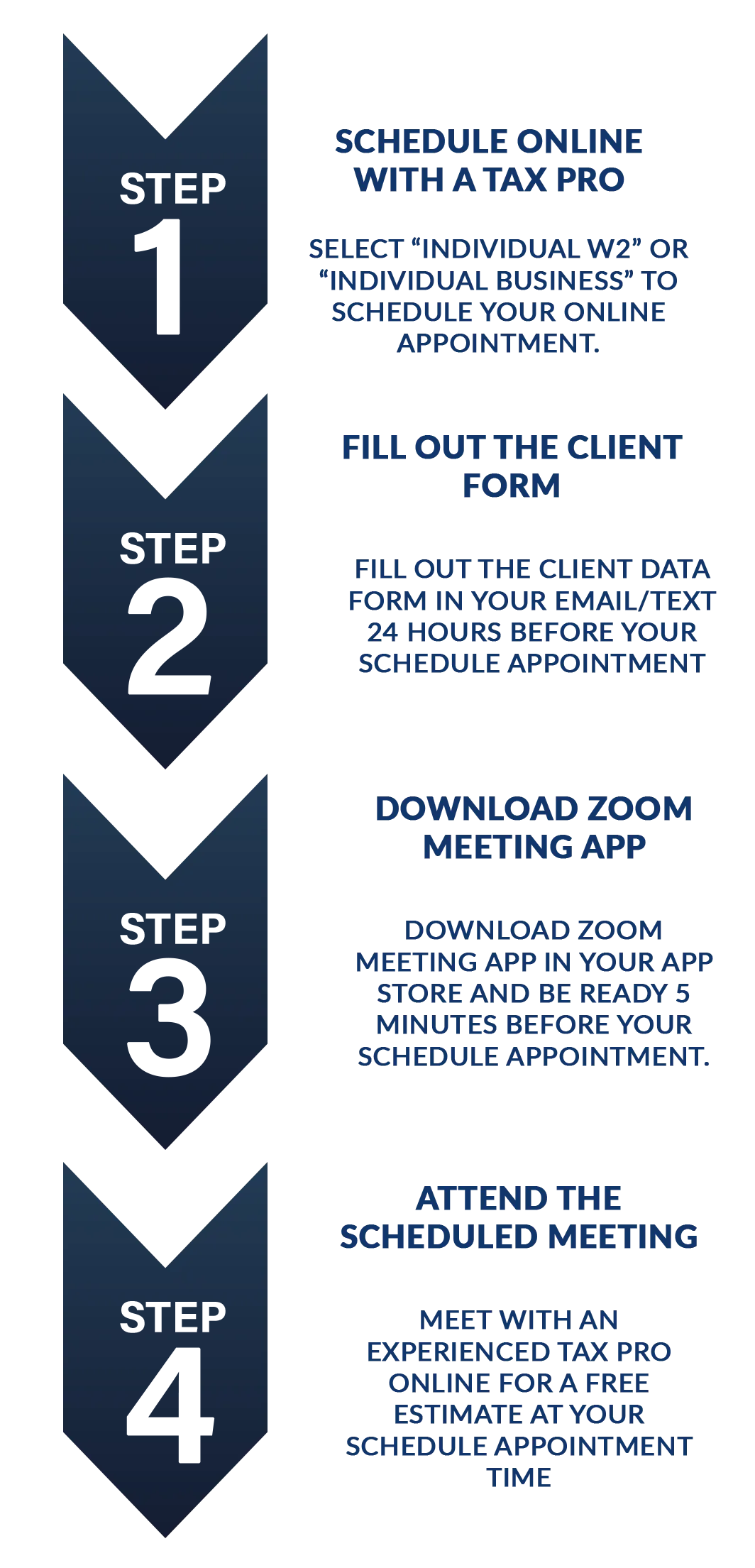

Online Tax Preparation Process

Frequently Asked Questions:

What documents do I need to prepare my taxes?

You will typically need documents such as W-2 forms, 1099 forms, investment income statements, mortgage interest statements, and records of any deductible expenses.

When is the tax filing deadline?

For most individuals, the tax filing deadline is April 15th. However, this date can vary, so it's important to double-check each year.

What are the benefits of using a professional tax preparer?

Professional tax preparers can help you maximize deductions, navigate complex tax laws, and ensure accurate and timely filing, potentially saving you time and money in the long run.

Can I e-file my taxes through your website?

Yes, we offer e-filing services to make the tax filing process convenient and efficient for our clients.

What should I do if I can't pay my taxes in full by the deadline?

If you can't pay your taxes in full by the deadline, you should still file your return on time and pay as much as you can to minimize penalties and interest. You may also consider setting up a payment plan with the IRS.

What tax credits and deductions am I eligible for?

Our tax professionals can help you identify tax credits and deductions you may be eligible for based on your individual circumstances, potentially reducing your tax liability.

How long does it take to receive my tax refund?

The time it takes to receive a tax refund can vary, but e-filing and choosing direct deposit can generally speed up the process, with most refunds issued within 21 days of filing.

What if I have income from multiple states?

If you have income from multiple states, you may need to file state tax returns for each state where you earned income. Our tax experts can assist you with filing multi-state returns.

What records should I keep for tax purposes?

It's important to keep records of income, expenses, and other tax-related documents for at least three years. These records may include receipts, bank statements, and previous tax returns.

What is the penalty for filing taxes late?

The penalty for filing taxes late is usually 5% of the unpaid taxes for each month or part of a month that a return is late, up to a maximum of 25%. If the return is more than 60 days late, the minimum penalty is $435 or 100% of the unpaid tax, whichever is less.

What happens after I submit my client data form?

One of our tax professionals will review your information and call with 24 hours for a free estimate.

How do I Contact you about my free estimate?

Office: 561-208-1222

Email: [email protected]

What documents do I need to verify my Identification?

ID, Taxpayer Social Security Card, and Dependent Social Security Cards.

What documents do I need to verify my filing status and address?

Utility Bill, Lease, Cable Bill.

What documents do I need to verify my dependents relationship

Birth certificate, Adoption statements, Government statements.

What documents do I need to verify my dependents residency?

Medicals records, School Records, Shot Records, or Lease with dependents names.

What documents do I need to verify my income?

W2, 1099’s, 1099k, Bank Statements, Receipt Book, Summary of Income & expense, Records of Expenses, Financial Transactions, Reconstruction of Income & expense, and any other income documents.

What supporting documents do I need to verify my small business or self-employment business?

LLC, EIN, website, pictures of business, prior year tax returns, business license, client testimonials, business plan, professional licenses, contract & agreements, business registration

CONTACT US

Subscribe to our social

Subscribe to our social

© Copyright 2024. First Family Trust LLC. All rights reserved. | Terms and Cpnditions | Privacy Policy

Designed By LeadProGiants